UK House Price Index - March 2020Rightmove's Monthly Analysis

The largest monthly sample of residential property prices

Strongest spring sellers’ market in the past decade

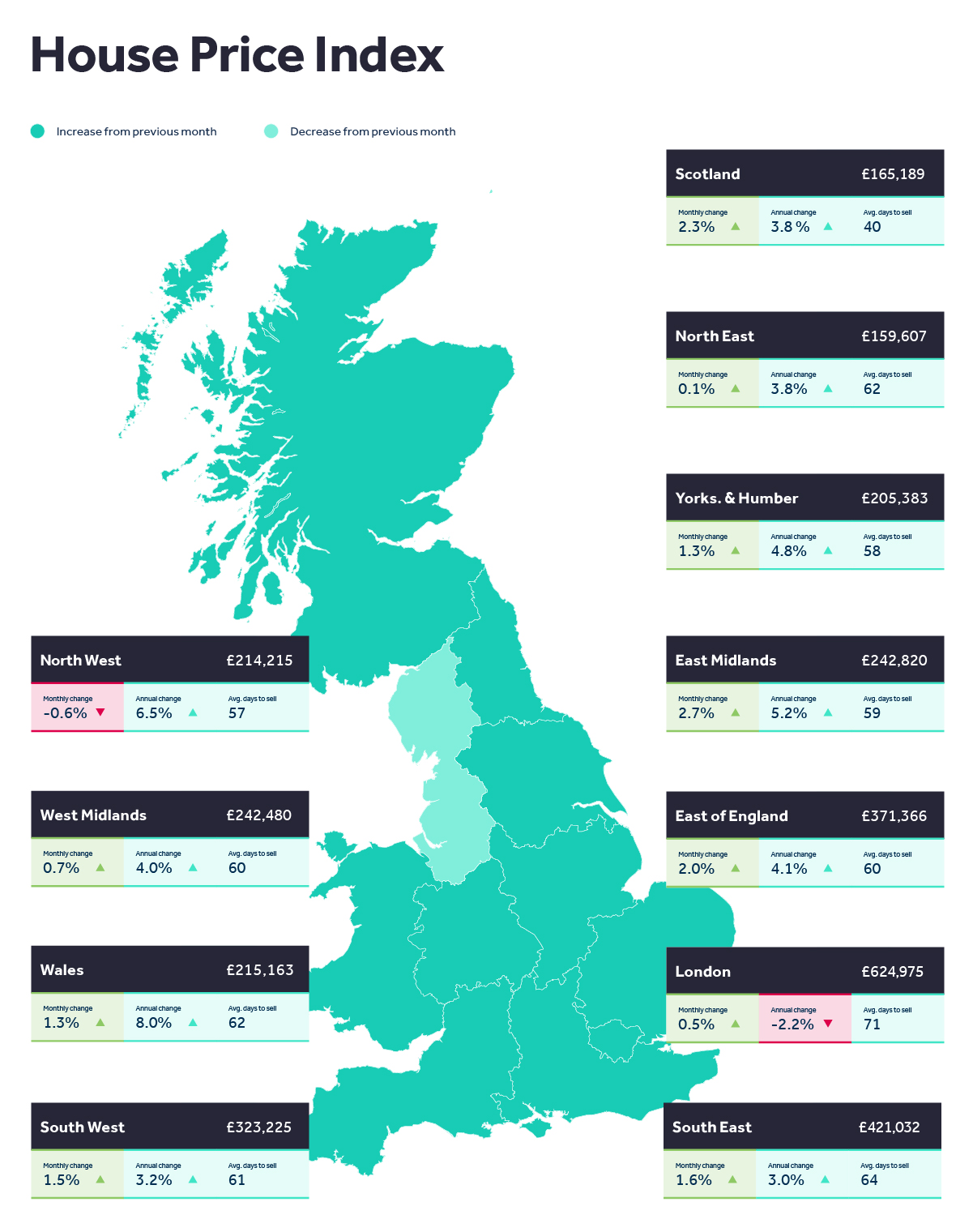

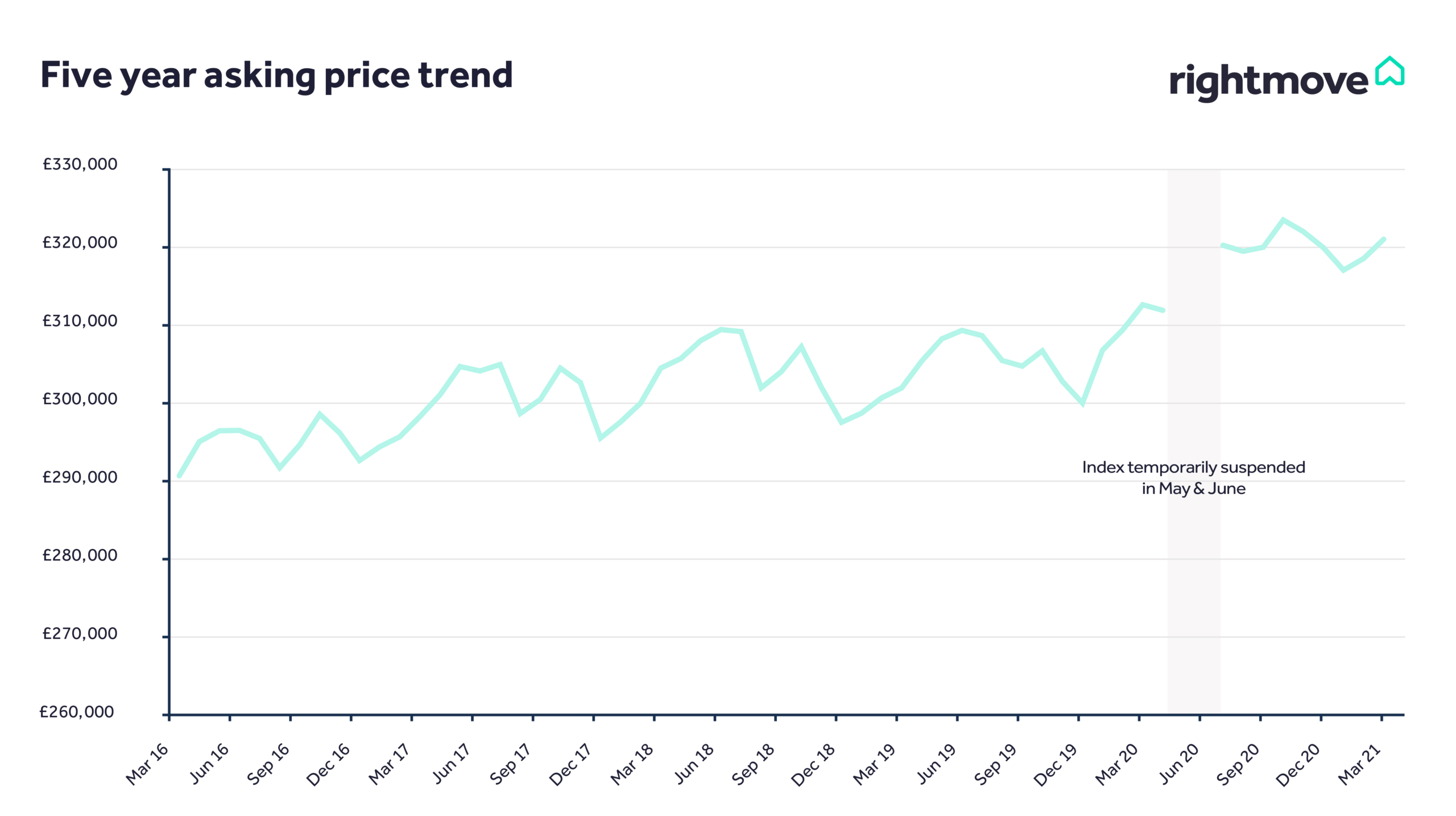

- Greatest excess of demand over supply over the past ten years, pushing up the average price of property coming to market by 0.8% (+£2,484) this month:

- Number of potential buyers enquiring about each available property in the month is at a record, and is 34% higher than the same period a year ago, which was itself an active market before the first lockdown

- With sales already agreed for almost two out of three properties on agents’ books, buyers eagerly await fresh choice coming to market, making this the best sellers’ market of the past ten years

- Start of traditional spring selling period sees number of sales agreed for the first week in March up by 12% on prior year despite shortage of available stock

- Daily average of over seven million visits to Rightmove in February, 40% up on February 2020

- Early signs that more owners are now deciding to market their properties, spurred by incentives and lockdown easing:

- New listing numbers see building momentum in weekly run-rate, only 5% down during the first week of March compared to 20% down for the month of February

- The tighter lending criteria put in place in 2014 will help to moderate the pace of price rises, but a sustained rise in fresh supply would also be a tempering factor

Overview

The average price of property coming to market rises by 0.8% (+£2,484) this month as buyer demand reaches record levels. With demand being driven by the side effects of the lockdowns and the additional spur of government incentives, we anticipate further price rises during the traditional spring selling season. For those owners who are thinking of coming to market, the current excess of buyer demand over supply is the largest we’ve seen in the last ten years and suggests that this could be one of the best ever Easters to sell.

Tim Bannister, Rightmove’s Director of Property Data comments: “Concerns of a cliff edge for the housing market at the end of March have dissipated, partly due to the tax deadline extensions in all of the UK bar Scotland, but also because the already high level of buyer demand caused by the lockdowns has continued to surge since the start of the year. This demand will be further boosted from April by the new Government guarantees enabling lenders to bring back 5% deposit mortgages. Whilst it is unfortunately not the perfect time to buy for some people who have been adversely affected by the pandemic, the record buyer demand measured by Rightmove indicates that now is the right time for many. Record low interest rates and the new focus on what your home needs to offer after several lockdowns have led us to the greatest excess of demand over supply in the last ten years. This strong sellers’ market is good news for those who are looking to put their home on the market as the traditional Easter selling season approaches. Blossoming buyer demand coinciding with blossoming gardens should put a spring in the steps of sellers, and more of them coming to market will provide a much-needed increase in the choice of property for the many who are looking to buy.”

The number of buyers enquiring about each property for sale on Rightmove is the highest ever measured. It continues to grow as the traditionally busiest period of the year approaches, and in February was 34% ahead of the same month a year ago, which was itself active and busy after the lifting of the uncertainty around Brexit and the election, and just before the first lockdown froze the market. The start of the traditional spring home-moving period saw the number of sales agreed for the first week in March up by 12% on the prior year. High levels of buyer demand have a clear correlation with high levels of sales being agreed by estate agents, and this record demand means that almost two out of three properties (62%) currently on agents’ books are now sold subject to contract. However there are early signs that this supply shortage may now be easing, with more owners deciding to market their properties, spurred by the extension of government incentives and a more tangible roadmap to normality. New listing numbers are seeing momentum building in their weekly run-rate, and for the first week in March were only 5% down compared to the prior year after being over 20% down in February.

Bannister adds: “So many sales have been agreed in recent months that we now face a serious shortage of homes available for sale. There are lots of reasons why many home-owners have hesitated to come to market during the first two months of the year, but these do now seem to be dissipating. A recovery in fresh supply gives more choice to prospective buyers, many of whom are also potential sellers, which in turn encourages more of them to come to market. Greater supply to match the high demand would ease upwards price pressure. Price rises will also be tempered by the tighter lending criteria imposed by the Bank of England upon lenders following the Mortgage Market Review in 2014. Restrictions on borrowers’ income multiples alongside stress testing of future affordability were specifically designed to guard against the destructive booms and busts of the past, limiting buyer borrowing power and preventing excessive price movements. The current annual rate of house price increase stands at a historically modest rate of 2.7%, but we stand by our forecast for the year of 4% which we published in December.”