In the Western world, it is extremely difficult to get rates of return in your bank that are over 1% per year – given how low interest rates have been for the last ten years. Living in China, it may be tempting to invest in cash deposits at slightly higher rates – but then there is the risk of the currency devaluing and the government putting more restrictions on moving your money out of the country.

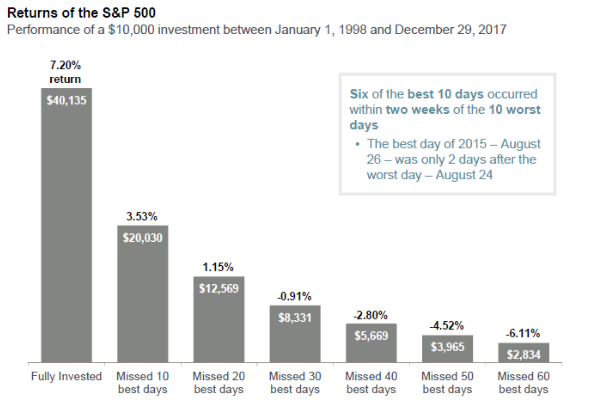

Once people look to invest in the market, there is always a worry about ‘timing’. The chart shows how missing the 10 best days in the market, over a 20 year period, can halve your return in that period. As Warren Buffet says, it’s time in the market that matters, not timing the market.

As an expat, you are in a unique position to be able to benefit from various different investment vehicles that are both tax-efficient but also give you access to a range of investments not available to domestic investors.