Many Brits, and those that spent time working in the UK, have built up a pension pot with the companies they were working for. Despite the amount of news coverage it receives, the pension crisis in the UK is affecting many expats hoping to enjoy an early retirement.

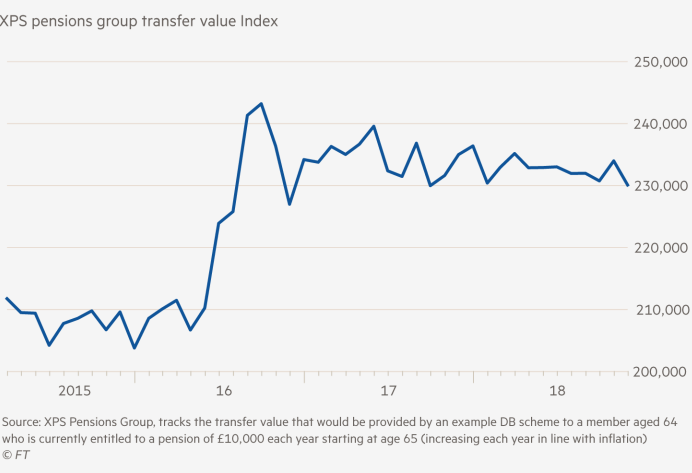

Pension Transfers Values have risen sharply

Most UK companies are unable to afford to keep paying their former employees a salary for life, largely due to the rising costs of providing the benefits and the fact that we are living much longer in retirement. If the company is not able to pay it’s pension liabilities, then the pension is moved into the PPF – where you are guaranteed to receive a significant reduction in retirement income.

Many expats do not keep track of their UK pension, unaware that if they were to pass away then only half of their pension goes to their spouse and none of it to their adult kids. The fact they get heavily penalised if they access the pension before 65 years old, and then do not have flexibility in the amount they can withdraw, puts a lot of people in a very difficult financial position.

As an expat, you have options available to you that ensure you can get flexible access to your pension from the age of 55 years old. You will also be able to ensure that your beneficiaries receive 100% of your pension should something happen to you, as well as ensuring that your pension is secure regardless of your former company’s financial status.